Market Musings: November 1, 2023

VIX, SPX, ARKK, TLT, QRA Announcement, Powell

Informational purpose only. Not financial advice. Consult with a competent financial professional before acting on any of this information.

The VIX is at a pivotal spot testing its 9-15-2023 uptrend line. I’ll be watching this closely for a breakdown or bounce. I suspect we’ll get a bounce from here but not taking any position.

SPX bounced off of its 12-2022 4,100 support line recently, which is a natural area to test after ripping downwards since mid-October. I do not see any evidence at this time that this is anything more than a normal, healthy bounce in a downtrend. I still expect it to test its major green 3-2020 Covid uptrend line around 4,000.

ARKK is testing is major multiyear 2018 $34.75 support line. I’ll be watching this spot carefully. If we’re entering a new bull market, shitcos should be showing strong leadership here. Instead, today, and recently, they’ve been showing relative weakness.

Below is ARKK’s 2-year daily chart. Notice how many times since May 2022 it has tested its major support line. Typically, the more times a stock or ETF or whatever tests major support, the more likely it is to break under it, particularly since it has briefly done so already in January. I expect ARKK will ultimately break under this support at some point.

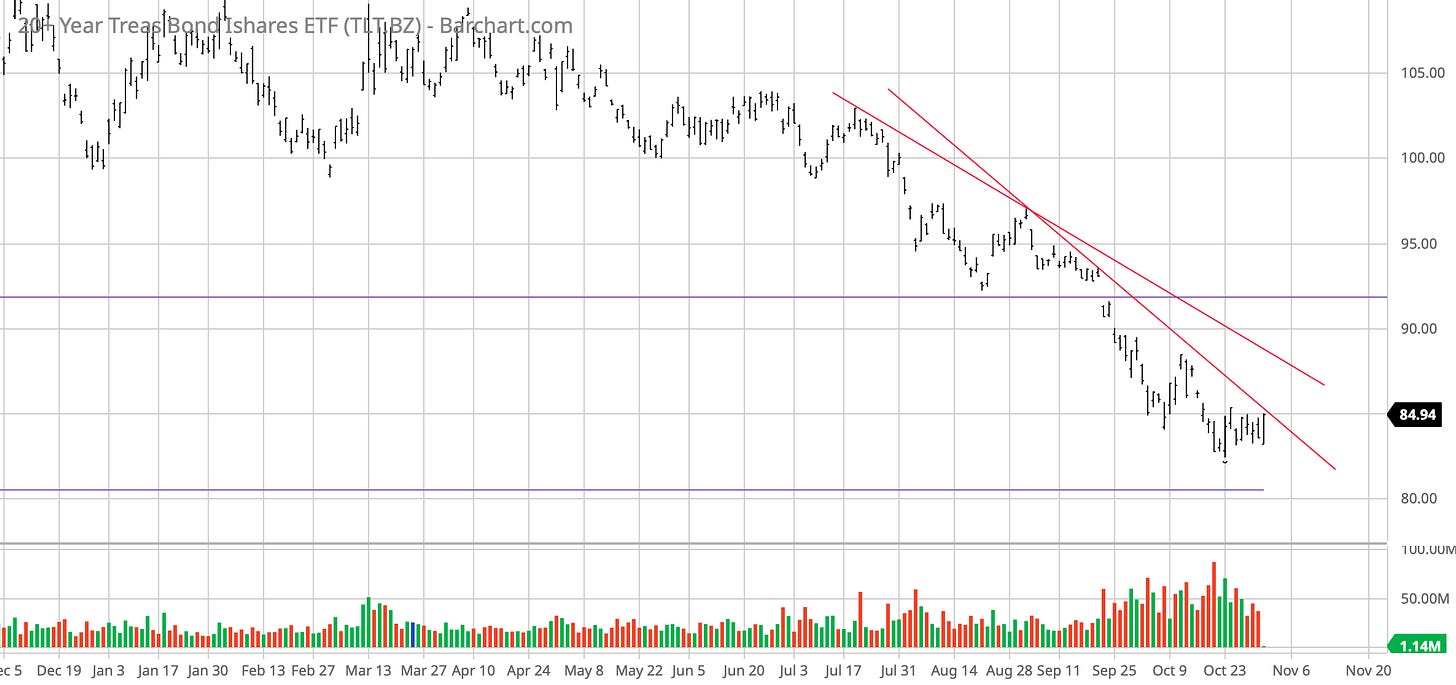

TLT is at a pivotal spot, testing it first red downtrend resistance line today. I’ll be watching this like a hawk. (I have no position in TLT.)

The treasury’s QRA announcement this morning seemed to provide some relief to treasuries. However, although equites are up, they did not bounce big. I am of the belief that the main problem the market is grappling with, its albatross that is causing it to downtrend, is the 30-year treasury yield being above 5%. Once a market’s albatross is resolved, it tends to reverse immediately and in a big way (think October 13, 2022, when SPX shot up 5% from the low of the day following Nick Timiraos’s tweet). Although the 30-year is currently slightly under 5%, I’m not seeing a huge bounce in equities today. Furthermore, the Russell 2000 is up slightly and ARKK is down. I’d expect to see all indexes (including small caps shitco’s) rising with force upon an albatross resolution. As such, I believe this is more of a relief rally after fearing the QRA announcement would be worse than it actually was and positioning for Powell at 2pm.

I agree with Bloomberg and expect Powell not to raise or lower rates today. I also expect him to strike a somewhat hawkish tone (particularly with a hot economy and job openings unexpectedly rising a second month). I believe the press release and press conference will largely resemble the last few ones (inflation is still concerning, will not raise rates now, do not expect to lower them for some time, won’t stop until inflation is at 2%, data will determine whether we raise rates in the future, etc.) Read the Bloomberg article here.